Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found here.

Brussels has started the clock on a review of the European steel operations merger of Tata Steel and ThyssenKrupp, a landmark deal that would create Europe’s second largest steel producer. Europe’s competition commission opened its initial investigation into the tie-up on Tuesday and will need to decide by 10 October to either approve it or launch an in-depth probe. The investigation will examine how the deal could cut competition and may require the sale of assets in areas where the two companies have significant overlap. After more than two years of courtship and negotiations with activist investors and labour unions, the producers agreed in June what would be the biggest shake-up of Europe’s steel industry for more than a decade. Tata Steel and ThyssenKrupp will join their steelmaking operations on the continent to create a 50-50 joint venture with €17bn in revenues and 48,000 employees. TK-Tata would control roughly 27 per cent of the European market for flat steel, behind ArcelorMittal with 38 per cent, according to analysts and bankers. Problems are most likely to come in the speciality and niche product areas where the combined group would be strongly dominant, such as tin-plate for food packaging and electrical steels. The deal is an important step in the sector’s consolidation that executives have long argued is vital in the face of overcapacity, cheap imports, and, now, US tariffs on foreign metal. The group expects to make €400m-€500m in annual cost savings across its 34 sites, all while keeping the peace with highly unionised workforces. Some 4,000 jobs are expected to go, split equally between the two sides.

British Steel is cutting 400 jobs at its sites in the UK and elsewhere in Europe as it blamed a weak pound and euro for driving up costs.

British Steel is cutting 400 jobs at its sites in the UK and elsewhere in Europe as it blamed a weak pound and euro for driving up costs. Behind the gates of the factory, surrounded by a hospital, a shopping mall and high-rise apartment blocks, workers and bulldozers were busy on a recent visit tearing down furnaces as part of a 38 billion yuan ($5.5 billion) plan to move to a new industrial park 60 kilometers (37 miles) away.

Behind the gates of the factory, surrounded by a hospital, a shopping mall and high-rise apartment blocks, workers and bulldozers were busy on a recent visit tearing down furnaces as part of a 38 billion yuan ($5.5 billion) plan to move to a new industrial park 60 kilometers (37 miles) away. Hebei’s aim is to cut steel capacity to 200 million tonnes per year (tpy) by 2020, down 20 percent from 2017. Jiangsu, China’s second-largest steelmaking region, issued a similar plan in August.

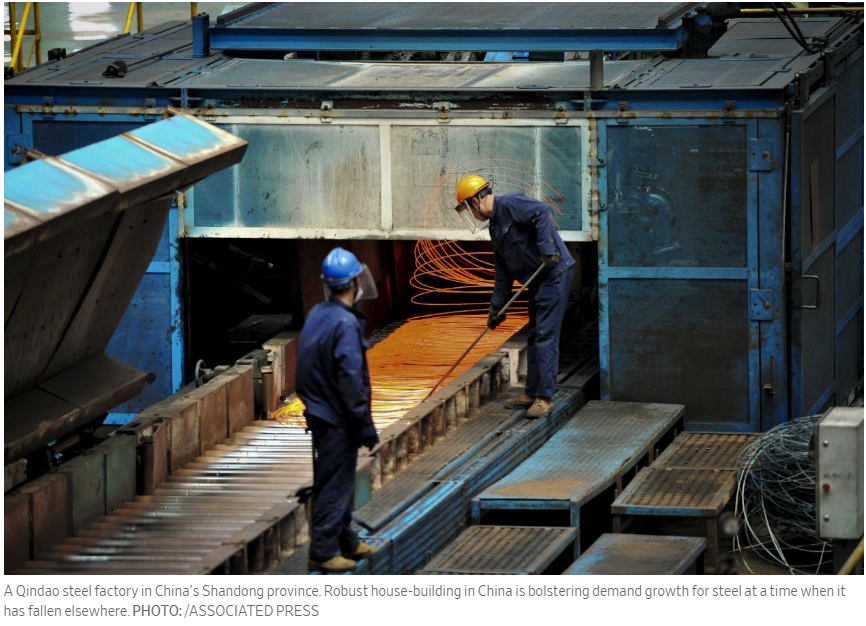

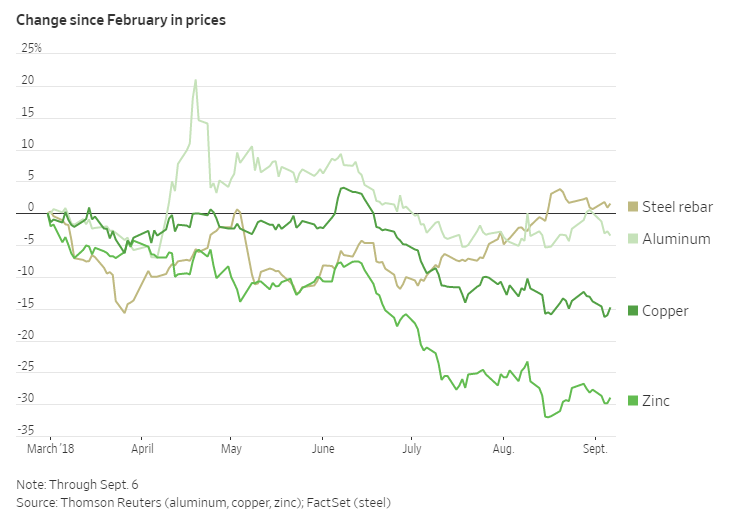

Hebei’s aim is to cut steel capacity to 200 million tonnes per year (tpy) by 2020, down 20 percent from 2017. Jiangsu, China’s second-largest steelmaking region, issued a similar plan in August. The price of steel is rallying, thanks to China, even as concerns about the country’s growth prospects pressure other metals.

The price of steel is rallying, thanks to China, even as concerns about the country’s growth prospects pressure other metals. “If you look at the end-of-the-line data, real estate has been doing very well and outperformed expectations,” said Serafino Capoferri, commodity research analyst at Macquarie.

“If you look at the end-of-the-line data, real estate has been doing very well and outperformed expectations,” said Serafino Capoferri, commodity research analyst at Macquarie.