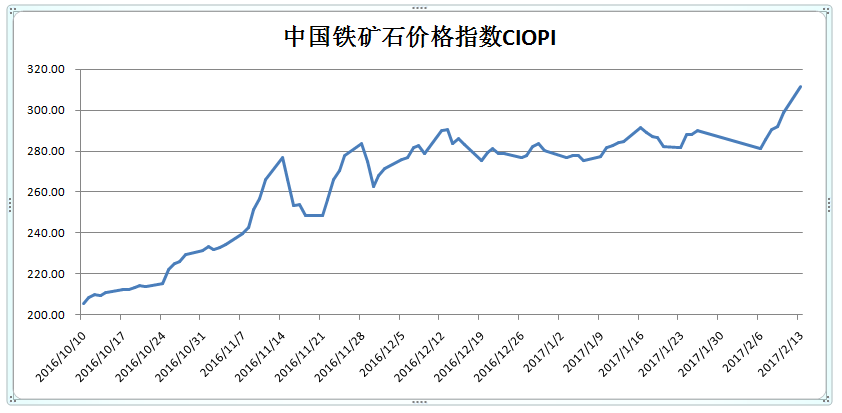

China steel price CIOPI 298.85 10, China’s iron ore price index, CIOPI311.62 13, China’s iron ore price index, or line 12.77, or fall by 4.27%. in 2017 the china steel material Price had Big Rising. As the Chinese government to improve the requirements of environmental protection , the china steel price will have more rising.

| Data | China’s iron ore price index CIOPI | Rise and fall (RMB) | Ups and downs |

| 2017/2/13 | 311.62 | 12.77 | 4.27% |

| 2017/2/10 | 298.85 | 6.67 | 2.28% |

| 2017/2/9 | 292.18 | 1.72 | 0.59% |

| 2017/2/8 | 290.46 | 4.91 | 1.72% |

| 2017/2/7 | 285.55 | 4.55 | 1.62% |

| 2017/2/6 | 281.00 | -8.93 | -3.08% |

| 2017/1/26 | 289.93 | 2.09 | 0.73% |

| 2017/1/25 | 287.84 | -0.31 | 0.11% |

| 2017/1/24 | 288.15 | 6.36 | 2.26% |

| 2017/1/23 | 281.79 | -0.32 | -0.11% |

| 2017/1/20 | 282.11 | -4.65 | -1.62% |

| 2017/1/19 | 286.76 | -0.55 | -0.19% |

| 2017/1/18 | 287.31 | -1.59 | -0.55% |

| 2017/1/17 | 288.90 | -2.46 | -0.84% |

| 2017/1/16 | 291.36 | 6.79 | 2.39% |

| 2017/1/13 | 284.57 | 0.24 | 0.08% |

| 2017/1/12 | 284.33 | 1.80 | 0.64% |

| 2017/1/11 | 282.53 | 1.04 | 0.37% |

| 2017/1/10 | 281.49 | 4.11 | 1.48% |

| 2017/1/9 | 277.38 | 2.18 | 0.79% |

| 2017/1/6 | 275.20 | -2.81 | -1.01% |

| 2017/1/5 | 278.01 | 0.34 | 0.12% |

| 2017/1/4 | 277.67 | 0.77 | 0.28% |

| 2017/1/3 | 276.90 | -3.45 | -1.23% |

| 2016/12/30 | 280.35 | -3.35 | -1.18% |

| 2016/12/29 | 283.70 | 1.43 | 0.51% |

| 2016/12/28 | 282.27 | 4.30 | 1.55% |

| 2016/12/27 | 277.97 | 1.31 | 0.47% |

| 2016/12/26 | 276.66 | -2.05 | -0.74% |

| 2016/12/23 | 278.71 | -0.18 | -0.06% |

If you have any special steel, tool steel, high speed steel inquiry or problems, pls feel free contact us.

el: 0086-769-33232622

Fax: 0086-769-88705839

Email (English): jack@otaisteel.com

Email (Español): jack@otaisteel.com