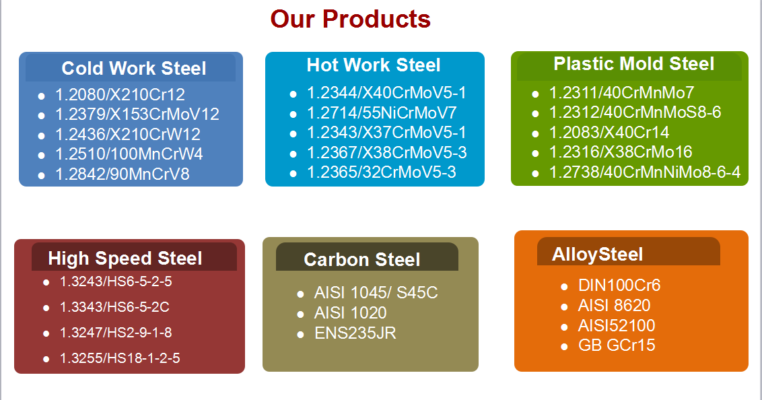

I am here to say hello to everyboby who will see this website page , this is Monica Yu from Otai Special Steel , we are specialized in produce High speed steel M2 , Hot and Cold work tool steel , Plastic mold steel , Quenched and tempered alloy steel 4140 , Carbon steel , Bearing steel and Gear steel for 16 years , 4140 / M2 from Otai Special Steel , all our productions are suitable for a variety of applications , know more about our company and production , please log in our website : www.otaisteel.com , hope we will have chance to co-operation with each other in the future , thanks !

I want to tell you story about Otai Special Steel with me , i have working for this steel company from 2013 , and till now have more than 6 years , for these years , 4140 / M2 from Otai Special Steel , i get the customer from Argentina , Ecuador , Bulgaria , Kuwait , Indonesia …… , and they purchased any kinds of special steel like : 1020 / 1045 / 4140 / 8620 tubes and 4140/1.2311 / M2 / 65Mn / Cr12Mov / 34CrNiMo6 ….. sheet plate and round bar and flat bar and Specification material from us , when they finished the first time purchase , i always ask for them to get the situation after use , and sometimes they may did not know how to use them in the best way , but after cocommunicate with each other , we try our best to come to an agreement and make full use of the materials finally , and for the first time, a good experience , the customer may have repeat order to us again about their purchasing cycle .

It’s in the other place , i may care for the regular customer for the details from life , my customer from Argentina have twin baby last years , and for this Oct. he have visited our company for the every year regular action , (last year his elder brother and his father visited us ,) and they take the Homemade red wine to me for gift , and i prepare the Lego blocks for his two baby , we are all very happy to get the present from each other , after he came back to home , he may send the picture to me , that is his baby are very happy playing with my gift , that is say the business not only to the production , 4140 / M2 from Otai Special Steel , we could bring it to our life also . You may found happy from anywhere .

Fax: 0086-769-88705839

Email: jack@otaisteel.com