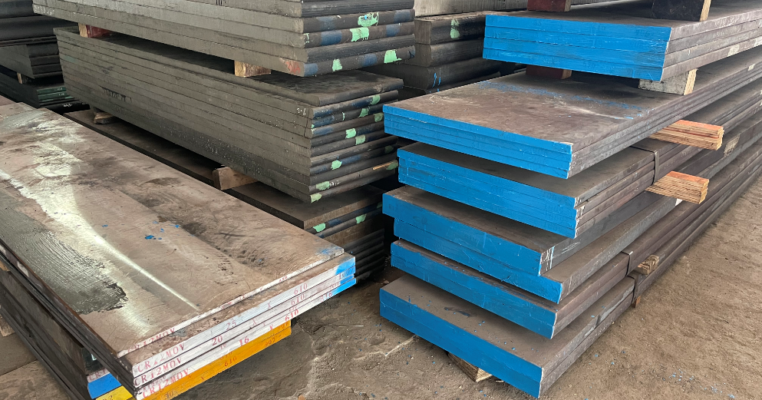

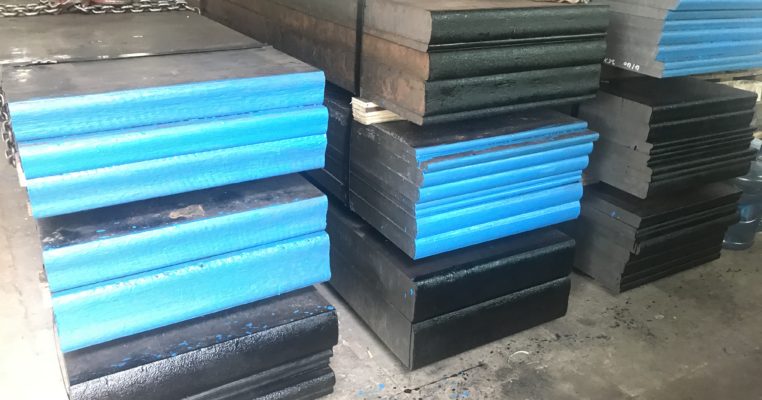

On December 18, the intraday price of the main domestic iron ore futures contract reached 1132.5 RMB/ton.It was double the price of 511RMB per ton at the lowest point during the year, setting the highest record during these 8 years. The crazy material cost of Iron Ore, makes the 4140 steel plate price increased in a higher level.

Since 2015, China’s foreign dependence on iron ore has exceeded 80%. It is higher than our country’s foreign dependence on crude oil (70%). In 2019, China’s iron ore imports reached 1.069 billion tons. It is of which 665 million tons came from Australia and 229 million tons came from Brazil. The former accounted for 62% the latter accounted for 21%.

Analysis shows the imbalance between supply and demand is the main reason. It is affected by the increase of funds under the monetary easing. In 2021, major mines in Australia and Brazil will have few new capacity additions. While global steel production will continue to increase. And iron ore supply and demand will be further imbalanced. The recent surge in iron ore prices is an early response to this. Iron ore supply may continue to be tight in the next few years.The industry predicts the price of iron ore will still fluctuate at a high level in 2021. it may be in the range of 20%-65% higher than the average price in 2020.

And most of the customers keep waiting and expecting the 4140 steel plate price be reduced in 2021.

But from current situation, the 4140 steel plate price and other steel cost must be increasing. So the sooner you make the purchasing planning, the better price you could have. Normally the faithful words can’t not be heard.Some customers are very regret on not buying in last Dec, now they spent more cost fee on the purchasing. And for some people are still keeping waiting and watching at this moment, they will have the same bad experience after weeks and months.

Tel: 0086-769-23190193

Fax: 0086-769-88705839

Email:jack@otaisteel.com