The price of steel is rallying, thanks to China, even as concerns about the country’s growth prospects pressure other metals.

The price of steel is rallying, thanks to China, even as concerns about the country’s growth prospects pressure other metals.

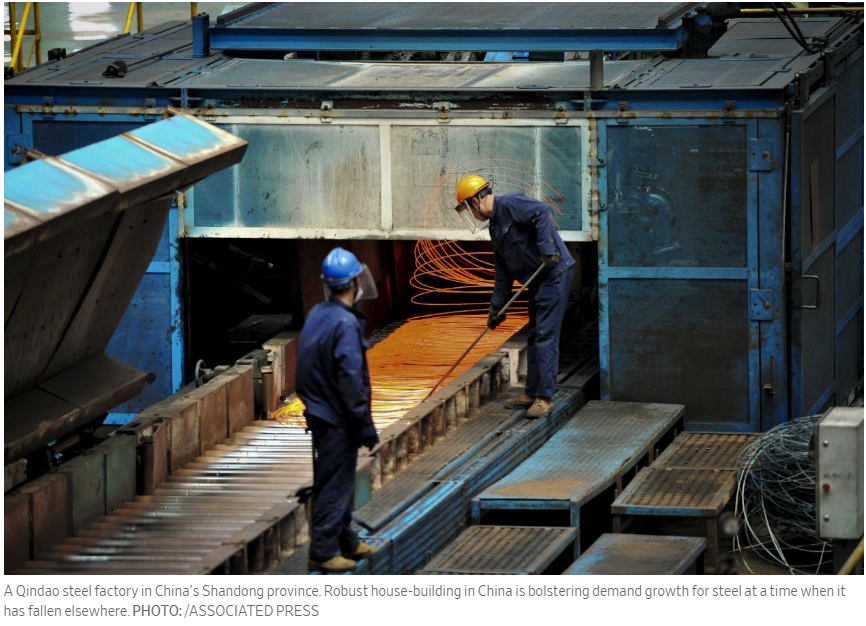

Beijing is expected to cut steel production to help reduce pollution, which would curb supply, while construction of new houses in China is cushioning a drop-off in demand elsewhere.

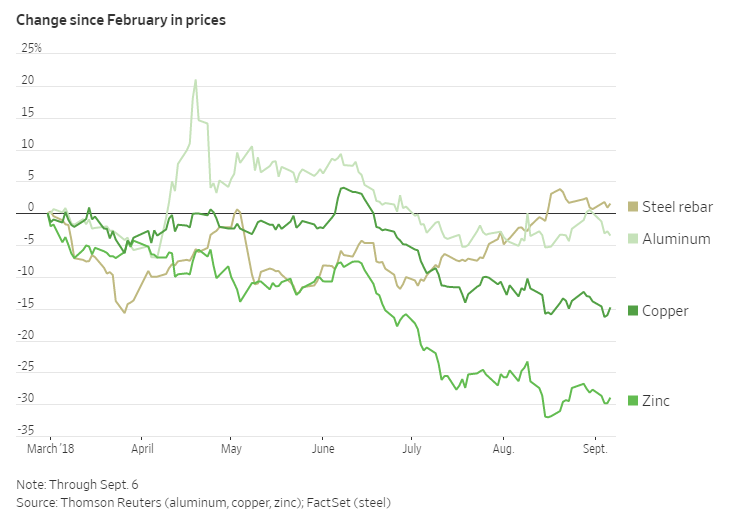

That has helped boost the price of steel rebar futures by more than 15% over the past three months—a period in which almost all base metals have fallen by double-digit percentages.

“If you look at the end-of-the-line data, real estate has been doing very well and outperformed expectations,” said Serafino Capoferri, commodity research analyst at Macquarie.

“If you look at the end-of-the-line data, real estate has been doing very well and outperformed expectations,” said Serafino Capoferri, commodity research analyst at Macquarie.

China is responsible for consumption of around half of metal production. Concern that growth in the country is slowing, and wider worries about emerging markets and global trade, have pummeled metals other than steel.

The price of copper is down 17% since early June, while zinc is down 27% and aluminum is down 11%.

Steel, though, is benefiting from expectations that China will curb supply this winter.

Last winter, cuts aimed at improving air quality in cities near steel mills—coal-burning furnaces are a major source of smog—led to the shuttering of roughly 180 million tons of China’s approximate 1.1 billion tons in production. Looking ahead, Macquarie calculates that almost 50% of Chinese production may be taken out of action this winter.

With supply looking tight for the rest of 2018 and demand from China’s housing market still strong, commodities investors will be eager to secure reliable supply, analysts say.

“Consistent efforts to constrain supply have kept pricing at a healthy level,” said Seth Rosenfeld, managing director of equity research, metals and mining at Jefferies.

Chinese steel demand is up only 2% so far this year against double-digit growth in 2017, according to data from Jefferies, when demand for illegal production is removed from the equation.

The country’s robust housing sector is bolstering demand growth at a time when it has fallen in other markets. Around 35% to 40% of Chinese steel demand comes from building construction, according to Macquarie.

In July, China’s house price index notched its sharpest increase in 10 months, while the market’s stock-to-sales ratio—a proxy for demand—and new property starts have picked up in recent months, according to data from Bank of China International.

Behind that buoyancy are two Beijing priorities, analysts say: redeveloping poorer areas, and cautiousness against hurting the economy by squeezing available credit in state-controlled areas like house-building.

The poor performance of China’s equity and bond markets has made it even more important that the government doesn’t rush its economic reforms, said Carsten Menke, commodity analyst at Julius Baer.

The Shanghai Composite Index has fallen more than 24% from its peak in January, while the yuan is down nearly 7% since June.

Write to David Hodari

One comment

Hi there, You’ve performed a great job. I’ll certainly digg it and individually recommend to my friends. I’m sure they will be benefited from this site.|